AI and the Creator Economy: Why This Matters Now

Business is changing fast—and so are the people shaping its future. A recent partnership between Visa and Karat Financial has brought a spotlight to a booming trend: using AI to help creators and small businesses manage money and grow smarter.

It’s not just about cool tech. The creator economy is swelling, with experts predicting creators will earn over $185 billion in 2025. That’s a 20% jump in just one year! This shift affects not just influencers but anyone building a business, marketing online, or seeking new digital opportunities. If you’re a decision-maker or business leader, understanding these AI-driven changes will put your organization ahead of the curve in a highly competitive world.

The Core Challenge: Financial Management Is Hard—AI Makes It Easier

Managing cash flow, invoicing, and vendor relationships is tough—especially when you’re also creating new products, delivering services, or building a brand. Creators, like small business owners, often face late payments, confusing contracts, and new tax rules. Visa’s new AI-powered program, launching with Karat in 2026, aims to fix these headaches by:

- Automating invoice prompts and reminders for unpaid bills

- Helping enroll bills in autopay, saving time and worry

- Offering an AI agent to review brand deal offers, so creators make smarter financial choices

All these features tackle real-world pain points. Kyle Hjelmeseth, CEO of a creator-management company, says brands delay payments more now than ever before, causing stress and uncertainty. These new AI tools don’t just automate tasks—they offer peace of mind and power better business decisions.

What This Means for Business Leaders

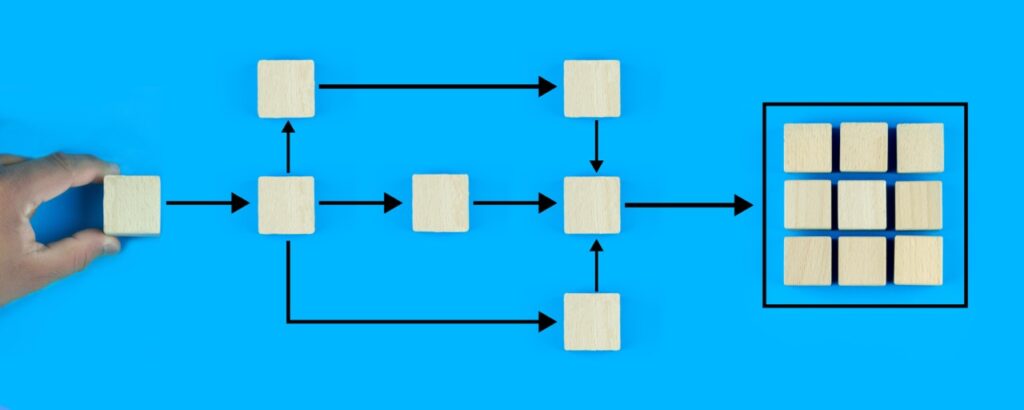

The exciting thing? Challenges faced by creators mirror those faced by startups and small businesses everywhere—managing cash, sorting contracts, and scaling operations. AI solutions like Visa’s aren’t just for YouTubers or TikTok stars. Nearly half of creators report being self-taught in business. As they grow, they need help with legal compliance, business strategy, and financial health. Smart automation can:

- Reduce manual errors and save hours every week

- Offer strategic insight through predictive analytics

- Help teams “do more with less” in a tough economic climate

This is where business-focused AI roadmapping and process optimization—what Silk Logic specializes in—come in. Custom AI applications aren’t a futuristic perk. They’re quickly becoming table-stakes for staying competitive, meeting customer demands, and managing costs sustainably.

How to Start: Action Steps for Leaders

If your organization manages contracts, payments, partnerships, or large data sets, AI automation offers quick wins and long-term advantages. Here’s how to get moving:

- Assess where manual, repetitive tasks drain your team’s time

- Consider pilot projects in financial workflows—like invoice processing or contract review

- Use data to spot patterns in cash flow and customer behavior, then automate responses

- Seek expert help for AI roadmapping to avoid costly pitfalls and focus on high-impact investments

Risks and Roadblocks: Smart Adoption, Not Hype

No technology is one-size-fits-all, and AI is no silver bullet. Some leaders worry about data security, ethical use, or getting a real return on their AI investment. Others fear employees won’t adapt easily to change. To succeed, approach AI tools as a strategic change management challenge:

– Start small, measure impact, scale up

– Invest in staff training and clear communication

– Partner with trusted experts for custom AI solutions aligned to your goals

The Future: Get Ahead or Risk Falling Behind

Automation and AI are transforming not just digital creators, but every business model—from banking to healthcare to logistics. As new AI-powered financial tools gain traction, early movers will be able to innovate faster, grow new revenue streams, and offer better experiences for both customers and employees.

Don’t wait for disruption to hit your industry—lead it. Organizations that take steps now will set the pace, while laggards risk falling further behind in efficiency and innovation.

Conclusion: Is Your Business AI-Ready?

The partnership between Visa and Karat Financial shines a light on where modern business is heading: more automation, smarter decision-making, and new opportunities for those who embrace change. The big question for business leaders today isn’t if AI will transform your industry—it’s when and how you’ll take action.

Ready to explore what AI can do for your company? Let’s discuss how Silk Logic’s AI roadmapping services can help you plan, implement, and optimize the right solutions for long-term success.